how to calculate a stock's price

Stock profit current stock price - cost basis n. Price Estimated EPS Trailing PE where Price is the variable.

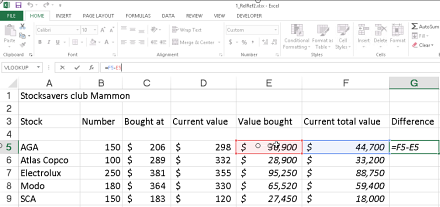

Calculating Return On Investment Roi In Excel

This will give you a price of 667 rounded to the nearest penny.

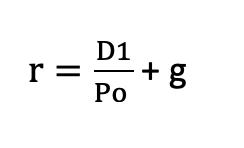

. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. Giving an indication of the companys overall size and worth. During a stocks initial public offering IPO the market has not yet had a chance to determine a stocks value.

Computing the future dividend value B DPS A. For example a 2-for. To find the market price per share of common stock divide the common stockholders equity by the average number of outstanding common stock shares.

Dividends are expected to be 300 per share Div. Yeah basically diff is the right function to. After we have calculated the cost basis for our stock it is time to calculate the stock profit.

The formula to calculate the target price is. The Stock Calculator uses the following basic formula. NS is the number of shares SP is the selling price per share BP is the buying price.

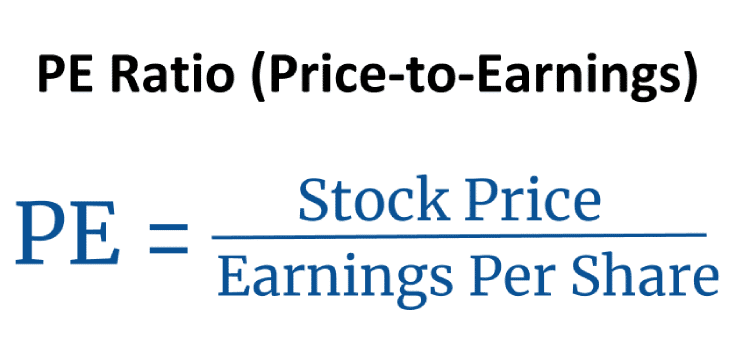

Value of Stock Number of Shares Price per Share. Compute the effect of stock splits on a real stock price. This price-earnings ratio Price-earnings Ratio The price to earnings PE ratio measures the.

It can be used to compare stocks of different companies within the same industry or of the same company with its past performance. The calculation is simple. In this case the adjusted closing price calculation will be 20 1 21.

Find a Dedicated Financial Advisor Now. How to Calculate share value Example. Divide the current share price by the stocks book value.

Divide the total value of the stock by the total number of shares. The algorithm behind this stock price calculator applies the formulas explained here. Price of Stock A is currently 10000 per share or P0.

Here look for the trailing PE as of December 31st 2019. Ad Ensure Your Investments Align with Your Goals. Finding the growth factor A 1 SGR001.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Last 12-months earnings per share. Searching for Financial Security.

Ad Dont miss out on opportunities open an account in 10 minutes. Forward PE ratio formula Price per shareProjected earnings per share read more. Calculating Todays Stock Prices.

Calculating expected price only works for certain types of stocks. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Dont miss out on opportunities open an account in 10 minutes.

Price sold Purchase pricePurchase price X 100 Percentage move The important thing about this formula is to always have the purchase price in the denominator. Stock bought at different periods in time will cost various amounts of capital. For newly established companies with rapid growth and unpredictable earnings and dividends future.

If the stock price goes up to. P D 1 r g where. Make the price comparable by dividing the stock price by the inverse the reciprocal of the stock split.

Our Financial Advisors Offer a Wealth of Knowledge. Ad Use this guide to understand bear markets and what they mean for your financial goals. Thats a fractional change.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We can rearrange the equation to give us a companys stock price giving us this formula to work with. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at.

The price of Stock A is expected to. 10000 250 40 per. That calculation might only work for one ticker not multiple tickers.

Stock price price-to-earnings ratio earnings per share. The initial stock pricing is usually decided by the investment bank. The book value is worked out from the balance sheet as total assets minus.

To get percent change you must multiple by 100. Stock value Dividend per share Required Rate of Return Dividend Growth Rate Rate of Return Dividend Payment Stock Price Dividend Growth Rate. If you buy the stock at 3 the PE ratio is 3 which is calculated by dividing the price of the stock by its earnings per share or 3 divided by 1.

Have a 500K portfolio worried about the stock market crashing. Of all the valuation metrics for stocks market capitalization is the most holistic ie. Get this must read guide.

Profit P SP NS - SC - BP NS BC Where. The buying price of stock typically varies every day due to the market. Annual Dividends per share.

Using the example the equation reads. Announces a 21 stock. Calculating the PE ratio of a stock is very easy.

Then divide by the number of shares issued.

Gordon Growth Model Ggm Formula And Excel Calculator

Take Small Positions If The Stock S Expensive Investing Value Investing Big Picture

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

Excel Formulas For Stocks Calculations An Excel Tip From Kalmstrom Com Business Solutions

Dividend Yield Formula With Calculator

Cost Of Common Stock Formula Accountinguide

This Free Online Stock Investment Calculator Will Calculate The Expected Rate Of Return Given A Stock S Current Dividend Investing Online Mortgage Online Stock

Gordon Growth Model Ggm Formula And Excel Calculator

Dividend Discount Model Ddm In 2022 Dividend Financial Modeling Interview Questions

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Calculate Monthly Returns On Stocks In Excel Financial Modeling Tutorials

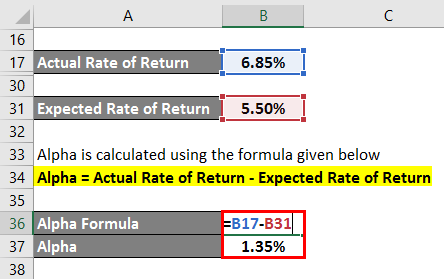

Alpha Formula Calculator Examples With Excel Template

How To Calculate The Intrinsic P E Of A Stock Quora

Implied Volatility To Discover Stock Price Expectations Option Party

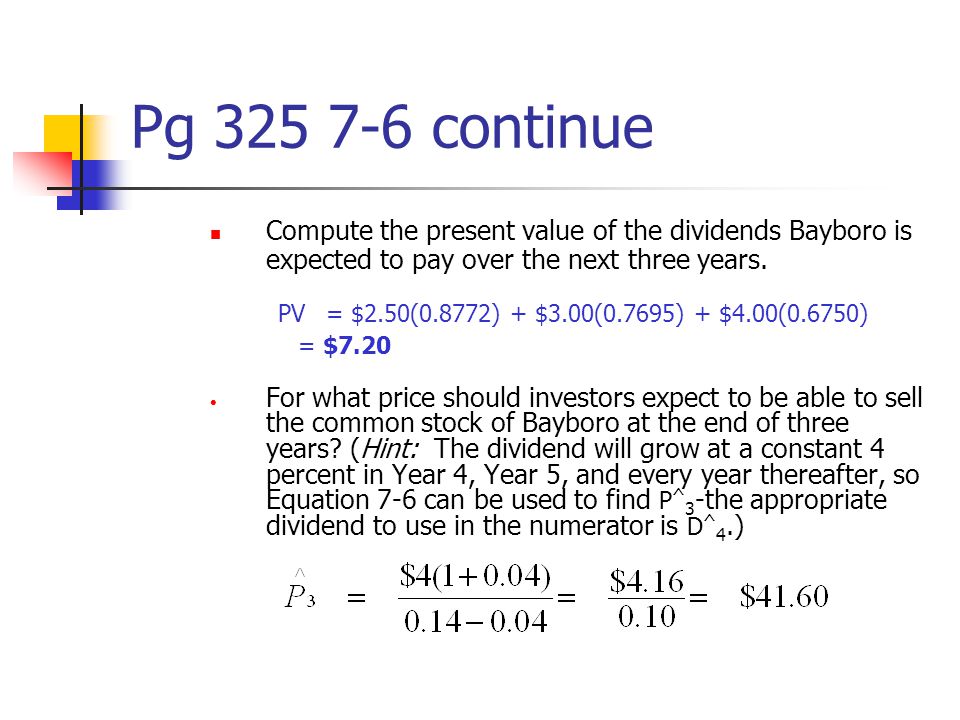

Besley Chapter 7 Assignment 5 Ppt Video Online Download

Calculating Intrinsic Value With The Dividend Growth Model Dividend Dividend Investing Intrinsic Value

Excel Formulas For Stocks Calculations An Excel Tip From Kalmstrom Com Business Solutions

Volatility Calculation Historical Varsity By Zerodha

Lookup Historical Stock Split Data For Specific Stocks Starbucks Stock Company Names First Site